Getting a divorce later in life can be difficult. However, if you’re getting a divorce over the age of 50, you’re not alone. In the past 25 years, the divorce rate among those over 50 has increased by more than 50%. Divorces past age 50 are also known as “gray divorces.” This term makes the proceedings sound a bit sad, but the good news is, they don’t have to be. In fact, a divorce can be the start of finding a way to be happy again.

Gray divorces are extremely common, and they happen for many different reasons. Some are due to situations older adults find themselves in, like lifestyle changes brought on by retirement or empty nest syndrome.

A divorce can be a lengthy and tiresome process. Before you begin, you’ll want to consider how to proceed financially. Read on for tips on how to get your finances in order during a divorce.

Think About The Long-Term

You’ll want to make sure your long-term finances are secure before finalizing divorce proceedings. Long-term care is important to consider, especially if you are 50 years old.

Don’t prioritize keeping real estate for sentimental value, especially if it’s going to drain your funds. Consider selling and downsizing. Usually, the cleaner the break, the easier it will be to adapt to changes.

Take Time To Process And Reflect

If you have the ability, you should take some time and think about what your plans are after your divorce. If you weren’t employed during your marriage, you may need to consider creating a source of income for yourself once your divorce is finalized.

Even if you’ll keep your same form of employment, going through a divorce can be exhausting, even if it’s better in the long run. Schedule rest time so you can re-evaluate before taking next steps. You’ll want to start the next phase of your life off on the right foot.

Make Adjustments To Maximize Your Finances

If you’re getting a divorce after age 50, you have less time to think about retirement. However, you should make sure you’re prioritizing your finances at this time. You’ll want to do what’s in your best interest for the future.

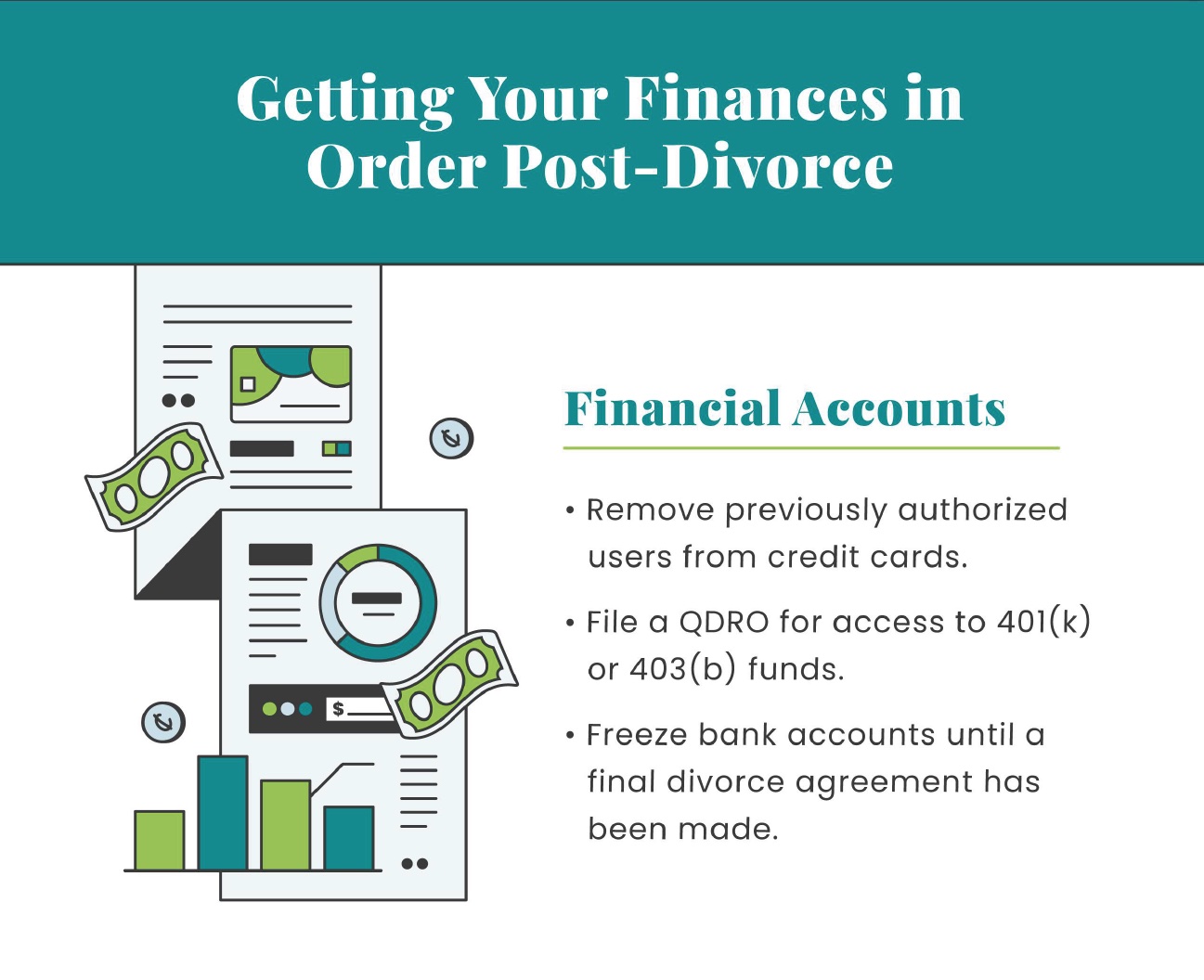

Financial Accounts

Whether it’s easy or difficult, the fair separation of joint financial accounts is something you’ll need to consider during the divorce. An individual retirement fund may be considered marital property.

This means the decision of how the funds are split will have to be included in the divorce settlement. In the case of 401(k) and 403(b) accounts, you might need to contact the plan administrator. Also think about how you want to split the funds in any checking, savings, or other shared accounts.

Real Estate

Bank accounts are more easily divided than something like real estate. However, there are a few steps you can take to simplify the division of properties. You can start by compiling a list of properties you own together.

Next, use Zillow or Realtor to determine the value of each property. Then, calculate the loans associated with each property and subtract those from the value. You can use the value of each property to determine how to best split your real estate.

Annuities

If your annuity is marital property, there are a variety of ways to split it fairly. You can withdraw the funds, transfer the funds to each person’s IRA, or transfer ownership or start a new contract with the divided funds.

Remember: state laws differ in the division of annuities, so check your state’s laws before making plans around the division of annuities.

Insurance

Another financial concern is insurance. Especially in later years, insurance is extremely important. If you’re on any joint insurance plans, you’ll need to seek out new plans. It can be a lot of paperwork, but that paperwork can save you tons of money. Do some research on insurance policies, and talk to your insurance carriers to see what will work for you.

You should also keep your social security benefits and the cost of your divorce in mind. Because there’s so much to do, remember step two—prioritize rest and reflection after this process!

However, once it’s all said and done, going through a divorce can also be the start of a fresh take on life. If the above infographics were helpful, you can download the full infographic here!

Download the free infographic

Did you know ‘gray divorces’ are quite common and can be hard to navigate financially? Tell us below.

For More Spotlight And Opinion/Life Tips, Check Out These Articles: