When it comes to consumer scams, we all know someone who was once a hapless victim, an unsuspecting pawn. Maybe she fit the archetype of the oh-so-gullible granny, the lovable sweepstakes sucker who, bless her heart, believed her lifetime of good karma had finally manifested in a million-dollar prize package (as long as she furiously typed out her Social Security number before the countdown clock on the screen expired).

Or maybe the target was one of your newly-catfished gal pals, who freely admitted she was a sucker for love, but never imagined the person behind the chat window was anyone other than the strikingly suave fellow in his social media photo — and certainly not a swindler with at least five victims wrapped around his greedy little finger.

Maybe, just maybe, the sucker in question was you. Because when a deep, forbidding voice told you to cough up your credit card or else an officer was coming to whisk you away in handcuffs, you panicked as you wondered whether you were in trouble for your overdue taxes or for the payday loan you blew off back in college.

I admit it: I very nearly became that particular sucker, and this exchange happened less than a year ago. Fortunately, my logical brain leapt in to unleash a can of whoop-ass on my lizard brain, and I slammed down the phone authoritatively before any disastrous decisions were made.

My point is, we’ve come a long way from the fake Nigerian princes of yore. Modern-day con artists seem to have shed their sophistication, opting instead to pose as the federal government or even the Internet boyfriend pleading for help with his son’s medical expenses (remember Paul Drabble from “Nine Perfect Strangers”, anyone?). Today, the alluring promise of riches from royalty has been replaced by fakeouts involving fear-mongering, falling in love, and falling prey to all sorts of pitiable pandemic schemes, as if we aren’t already surrounded with enough real-world tragedy.

Sadly, the latest stats on scams still look pretty grim – the Federal Trade Commission (FTC) received an increase in fraud reports throughout 2020, with a not-so-shocking surge during the early days of COVID-19. But don’t fret! You can arm yourself with knowledge to protect yourself from predatory practices. Read on to learn about five scary scams you need to be aware of right now, and how you (unlike me) can avoid nearly getting sucked in:

COVID-19 Scams

In the scamming world, one man’s tragedy is another man’s opportunity — so it’s no surprise that fraudsters would spin a disease that’s seized more than 5 million lives worldwide into a capitalist gold mine.

According to the U.S. Department of Health and Human Services (HHS) Office of Inspector General (OIG), swindlers have resorted to telemarketing calls, posts on social media platforms, text messages, and even door-to-door canvassing to spread scams related to the deadly virus, including by pushing snake-oil products that tout bogus benefits or promise a miracle cure.

“Fraudsters are offering COVID-19 tests, HHS grants, and Medicare prescription cards in exchange for personal details, including Medicare information. However, these services are unapproved and illegitimate,” the HHS OIG alerts consumers. “These scammers use the coronavirus pandemic to benefit themselves, and beneficiaries face potential harm. The personal information collected can be used to fraudulently bill federal health care programs and commit medical identity theft.”

So if you’ve unsuccessfully scoured the shelves for at-home antibody tests when you receive a convenient sales call from a zealous neighbor, buyer beware.

How To Avoid COVID-19 Scams

The FTC offers these tips to avoid COVID-19 scams:

-

Remember that COVID-19 vaccinations are free. If someone prompts you to pay out-of-pocket or order your vaccine online, you’re dealing with a scam.

-

Check with your medical provider before taking any product that claims to treat, prevent, or cure the COVID-19 virus. As of April 2021, the FTC had issued 30 warning letters to companies peddling fake treatments and cures.

-

Don’t post your vaccination card to your social media profile, as scammers could use this information for identity theft.

-

Don’t exchange money or personal information with anyone selling a national vaccine certificate or passport — this is always a scam.

-

Verify testing and vaccine requirements directly with airlines, cruise lines, and event venues.

Consult government sites like usa.gov/coronavirus and cdc.gov/coronavirus for pandemic-related information.

Impostor & Social Security Scams

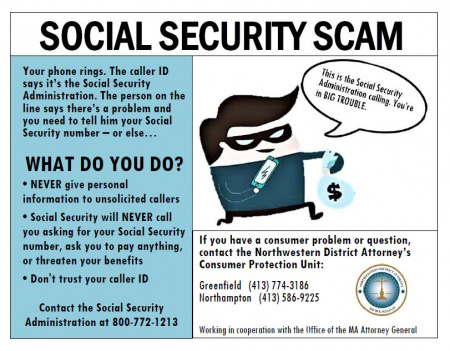

In an impostor scam, fraudsters pose as someone trustworthy, say from a government or law-enforcement agency, to convince you to send them money or personal information. Impostor scams are the most common form of fraud reported to the FTC, which received almost 960,000 complaints of this nature by September 30, 2021.

Social Security scams are the most common form of impostor scam, in which crooks pretend to contact you from the Social Security Administration (SSA). In 2020, the SSA Office of Inspector General (OIG) reported more than 718,000 scam complaints, a 50 percent increase from just the year before.

Here’s a common scenario: you receive a phone call from someone who claims to work at the SSA, who warns you that your social security number has been “suspended” for links to criminal activity. The scammer asks you to confirm your Social Security number so that you can reactivate it, or you can order a new number for a fee.

In another familiar scam, the fraudster will deliver news that seems too good to be true: you’ve just been awarded a major increase in your benefits, but you have to verify your Social Security number and other personal information to receive the money.

Whether the impostor’s scam tactic involves making or breaking your day, don’t fall for it!

How To Avoid Social Security Scams

The SSA offers these tips for avoiding Social Security scams:

-

Remember that the SSA will never:

-

Threaten you,

-

Suspend your Social Security number,

-

Demand an immediate payment from you,

-

Or require payment by cash, gift card, wire transfer, or prepaid debit card.

-

-

If you receive a questionable call from someone posing as the SSA, hang up and report it at oig.ssa.gov.

-

Ask someone you trust before making any large purchases or financial decisions.

-

Do not feel embarrassed to report that you were scammed or suffered a financial loss.

Learn more about Social Security scams at oig.ssa.gov/scam.

Romance Scams

He loves me, he loves me not – or is this a “sweetheart swindle”? The online romance scam has become so common that it was featured in a plot of the hit Hulu miniseries, “Nine Perfect Strangers.” In her own desperation to find love, the vulnerable romance writer Frances, portrayed poignantly by Melissa McCarthy, falls head over heels for a man on the Internet who leaves her catfished and heartbroken when he scams her out of money he claimed was for his young son’s medical bills.

Fortunately, poor Frances finds love elsewhere by the end of the show — but our own lives do not always wrap up so neatly in fairy-tale endings. According to the FTC, so-called romance scams hit a record high in 2020, reaching $304 million in losses in 2020.

In the typical romance scam, the “catfisher” connects with you from a fake profile on a dating website, often cultivated from stolen photos and ripped-off text from real accounts. The fraudster builds a fake relationship with you through romantic messages, photo exchanges, and maybe even live conversations on the phone. Just when the relationship seems serious enough, the scammer drops the heart-shattering bomb: he’s had a family emergency and needs you, his beloved soulmate, to send him money.

How To Avoid Romance Scams

The Better Business Bureau (BBB) offers these tips to avoid romance scams:

-

Look out for warning signs that your match is a scammer:

-

The photo is too hot to be true.

-

The relationship is moving too fast.

-

The person talks a lot about trust.

-

The person won’t meet, or tells you he lives overseas.

-

The person uses suspect language, including overly flowery language or poor grammar.

-

The person shares hard luck stories like financial troubles, a sick relative, or past trauma.

-

-

Never send money or personal information to someone you haven’t met in person. Do not give someone your credit card number to book travel to visit you.

-

Ask specific questions about details in the person’s profile, as a scammer may stumble to remember fake stories and lies.

-

Do your research! For example, you can see if a photo is stolen from somewhere else on the web by conducting a reverse image search at tineye.com or images.google.com.

Report a scam at the BBB Scam Tracker.

Job Scams

If you’ve re-framed the pandemic as a golden opportunity to ditch your dead-end job, you’re not alone. According to Prudential’s Pulse of the American Worker Survey, one in five respondents switched to a new job during the pandemic, and one in four intend to do so when pandemic stress subsides.

But just like seasoned scammers post fake profiles to dating websites, fraudsters can post fake job ads on job sites, social media, or even through text and email messages. The dubious job ad, often for a work-from-home gig that seems too good to be true, promises a new career opportunity for you but really just wants your personal information or money.

“One of the biggest scams that are circulating now is the email or text message offering a job with a huge salary,” says Scott Hasting, CFA and Co-Founder at BetWorthy. “The email or text contains a link to a WhatsApp or a website and the receiver needs to click that in order to be qualified for an interview.”

“Be careful as this is a phishing site and once you open the link, it will steal all your information, including your Social Security number as well as other passwords so [the scammer] can open your bank accounts and social media accounts,” Hasting advises. “Hence, do not open any suspicious links, even if coming from your trusted contacts as they might also have just been compromised.”

How To Avoid Job Scams

The FTC offers these tips to avoid job scams:

-

Do your research. Look up the name of the company in the job ad to see whether it’s legitimate. If you type in the words “scam,” “review,” or “complaint” in your search, you may find the supposed company has scammed other job seekers.

-

Talk to someone you trust about the job offer before responding to it.

-

Don’t pay to start a new job. Many scams promise that you’ll earn a lot of money but only after you pay for starter kits, “trainings,” or useless certifications. A legitimate employer will never ask you to pay to start a job.

-

Don’t fall for fake checks. No legitimate employer will send you a check and ask you to spend on that check as part of a job. The check will likely bounce, and you’ll be liable to repay your bank.

-

Use safe and reliable sources to search for a new job, such as USAJobs.gov and CareerOneStop.

Report job scams to the FTC at ReportFraud.ftc.gov or to your state attorney general.

Phishing Scams

Remember when Phish was the name of a progressive rock band, and Phish Food was a decadent flavor of Ben & Jerry’s ice cream? I do, too. But in the age of the Internet, phishing refers to when scammers use email or text messages to trick you into giving them personal information. Phishing emails may look like they were sent by a company you recognize and trust — such as your bank, a credit card company, or a subscription site — but they’re not affiliated with the legitimate company.

“Email phishing is incredibly common. Right now we are seeing a ton of phishing that aims to appear like it’s coming from a company like Costco, Home Depot, or other large corporations,” says Kristen Bolig, CEO of Security Nerd. “Sometimes fake government emails are more popular, but right now fake company emails are a bigger problem.”

Her advice as a security expert? “One of the easiest ways to determine whether or not an email you receive from a company is a scam, is to look at the email address it’s coming from,” Bolig advises. “If it’s legit, it will consist of the company name and maybe the department or action. If it’s not legit, there will likely be a string of random letters and numbers, and it will not directly indicate that it’s coming from the company. If there are spelling errors in the email body, that is a sign of a scam as well.”

How To Avoid Phishing Scams

The FTC offers these tips to avoid phishing scams:

-

Watch for these red flags that an email or text message did not come from a legitimate company:

-

The email tells you your account is on hold due to a billing problem.

-

The email uses a generic greeting (e.g., “Hi Dear”). If you have a real account with the company, the message would likely refer to your account name.

-

The email invites you to open a link and update your payment details.

-

-

Protect your computer by using security software and setting the software to update automatically. Enable the same settings on your mobile phone.

-

Protect your accounts by enabling multi-factor authentication (i.e., requiring at least two credentials to log in to your accounts, like a password and a verification code).

-

Report phishing attacks to the FTC at ReportFraud.ftc.gov, or forward the email to the Anti-Phishing Working Group at [email protected].

Have you been on the receiving end of an online scam? What other scams have you encountered? Share your stories of seedy scammers in the comments below.

Read These For More Ways To Improve Your Financial Literacy And Avoid Scams: