If you’re a podcast addict like I am, you’ve probably stumbled upon Freakonomics Radio, or maybe you’ve already become a loyal listener. A psychology nerd’s holy grail, the show geeks out about the “hidden side of everything,” from the origins of creative ideas to the curious economics of sleep. Since the show comes out past my bedtime on Wednesday, I queue up the latest episode every Thursday morning over my mega-mug of Death Wish coffee. Add a sprinkle of science to my breakfast routine? Don’t mind if I do.

So naturally, I was giddy with excitement when, a few months ago, the producers released a spinoff called Freakonomics, M.D., the brainchild of a physician-turned-economist who explores the intersection of economics and healthcare. So far, I’ve learned all sorts of fascinating, dinner-party-worthy trivia from the program. For instance, did you know that heart patients admitted to the hospital tend to have lower mortality rates when cardiologists are away at major conventions? How about that children with summer birthdays are more likely to contract the flu?

The topic of the latest episode is one I’ve pondered intermittently throughout my life, though never for more than a cursory moment. In the episode, titled “How Does Retirement Affect Your Brain?”, the scientist-host discussed research on the link between retirement age and cognitive decline. The findings? Not surprisingly (at least to me), evidence suggests that people who retire earlier are more likely to suffer cognitive deficits, including short-term memory loss and even dementia. Basically, it’s a use-it-or-lose-it situation.

Sleeping in and not checking your email are a few things to look forward to in retirement. Cognitive decline … not so much. This week on Freakonomics, M.D., does retirement actually cause cognitive decline? And if so, is there a way to prevent it? https://t.co/4fQ5vIbr5W

— Freakonomics, M.D. (@DrBapuPod) December 29, 2021

But wait – before you gasp in horror at the thought of taking the desk-jockey jitters to your deathbed, there’s a bit more to the story. According to the researchers, the process by which postponing retirement protects your brain is through building a larger cognitive reserve, an accumulation of resources through a lifetime of experiences. In other words, you can stave off senility by keeping your brain engaged, whether through work or from the pursuit of other passions. The problem for many people, at least in U.S. society, is that their identities are so wrapped up in work that they don’t know what to do with themselves once they leave their careers. They experience retirement as a major loss of self, and they accept brain atrophy as inevitable.

“Retirement means it’s now MY time. For some people, often men, their identity is so tied to their job that they’re scared to retire because they haven’t explored interests outside of work. Those guys work until they vapor lock. I didn’t want to live like that and die like that.” pic.twitter.com/V76yFXmb9Y

— Memoir for Me (@MemoirforMe) November 3, 2021

Luckily for me, I thought, I’ve never been one to define myself by my work. I’ve consumed enough psychology to know the importance of decoupling who I am from what I do, and to embrace the former. Plus, I have plenty of passions outside of work, including a spark for volunteerism. I’ve always had a zeal for climbing, but for me that’s mountains and skydiving altitude, not the fragile (and overcrowded) career ladder.

I finished the podcast and breathed a sigh of relief: I’m far too engaged with life to suffer mental decline when I stop working. That’s all there is to it, right? I’m set for a comfortable, cognitively active retirement.

Or am I? As I began to ruminate on the subject more deeply than I ever had before, I realized that it’s not cognitive decline I have to worry about during retirement. Rather, there’s a very different, more tangible type of decline I need to prepare for in my golden years: the decline of funds in my bank account.

Speak to me in psychobabble all day and we can have a smart conversation. But the minute you mention jargon like 401(k) and IRA, I’m as lost as a workaholic recently forced out of a career. However, planning for retirement is an inevitability that we all have to face sooner than later. In fact, financial experts recommend that we start saving for retirement in our 20s (haha). But don’t worry if, like me, you’ve procrastinating on your pecuniary priorities for too long: it’s never too late to begin the process.

Feeling like a fish out of water? I did, too. So I looked to the most far-sighted financial gurus for some fool-proof fiduciary advice. Read on and follow these timely tips, from top financial leaders, to prepare for the stress-free senior lifestyle of your dreams.

Set Goals

How can you plan for a comfortable retirement if you don’t even know what that means? The first step in preparing for your golden years is to set goals for how you envision them. “One of the most overlooked parts of planning for the future is imagining what you want your future to look like in the first place. It’s called ‘beginning with the end in mind’,” says Scott Alan Turner, C.F.P., a financial planner from Texas.

“Most people underestimate how much retirement will cost, then get overwhelmed, stressed out, and confused about how to piece everything together. Retirement planning is like planning for a vacation. You have to know where you’re going first,” Turner explains. “Then you start piecing together how you’ll get there, what to pack, what it’s going to cost, and all the fun things to do,” he says.

So whether your dream retirement includes a beach in Buena Vista or a ranch in rural farmland, think about your long-term goals and start planning with those in mind. “At a basic level, when you know what your lifestyle will cost, then comes the planning to pay for it,” Turner says. “There are lots of decisions to make, but the good news is the decisions aren’t cast in stone. There are lots of big and small tweaks to make. No matter what your current income or current savings are, there are ways to pay for goals. These positive changes you make today will carry forward for the next 30 to 50 years. That’s powerful, and it’s never too late to start,” he assures.

Contribute to Your 401(k)

There’s that pesky lingo again, the numerical soup that makes some of us squirm. But the 401(k) is actually quite straightforward: According to Investopedia, it’s simply “a retirement savings plan offered by many American employers that has tax advantages to the saver.” Basically, as an employee of a company, you agree to have a percentage of your paycheck paid into an investment account, and typically your employer will match at least part of that contribution.

Financial experts agree: it’s always a good time to start contributing to a 401(k) plan. “If you have an employer-sponsored plan, then maximizing your contributions to your employer’s match is a fantastic way to fund your golden years. Think of your employer’s match as free money that you’re giving up if you do not contribute to your company-sponsored retirement plan,” advises Kirsten Curry, a retirement planner from Seattle.

Invest in an Individual Retirement Account (IRA)

While it may seem like another angst-inducing acronym, an IRA is pretty simple, too. Like an employer-sponsored 401(k), an IRA is a retirement account that carries certain tax advantages, but it differs from the 401(k) in two important ways: 1) since an IRA is an individual account instead of a company account, it doesn’t include employer matching; and 2) an IRA typically has more investment options than a 401(k).

If you can’t decide which investment is better, don’t worry – you can contribute to both! Just make sure that you heed contribution and income limits imposed by the IRS, which typically change every year. (For the 2022 changes to contribution limits, see the IRS announcement here.)

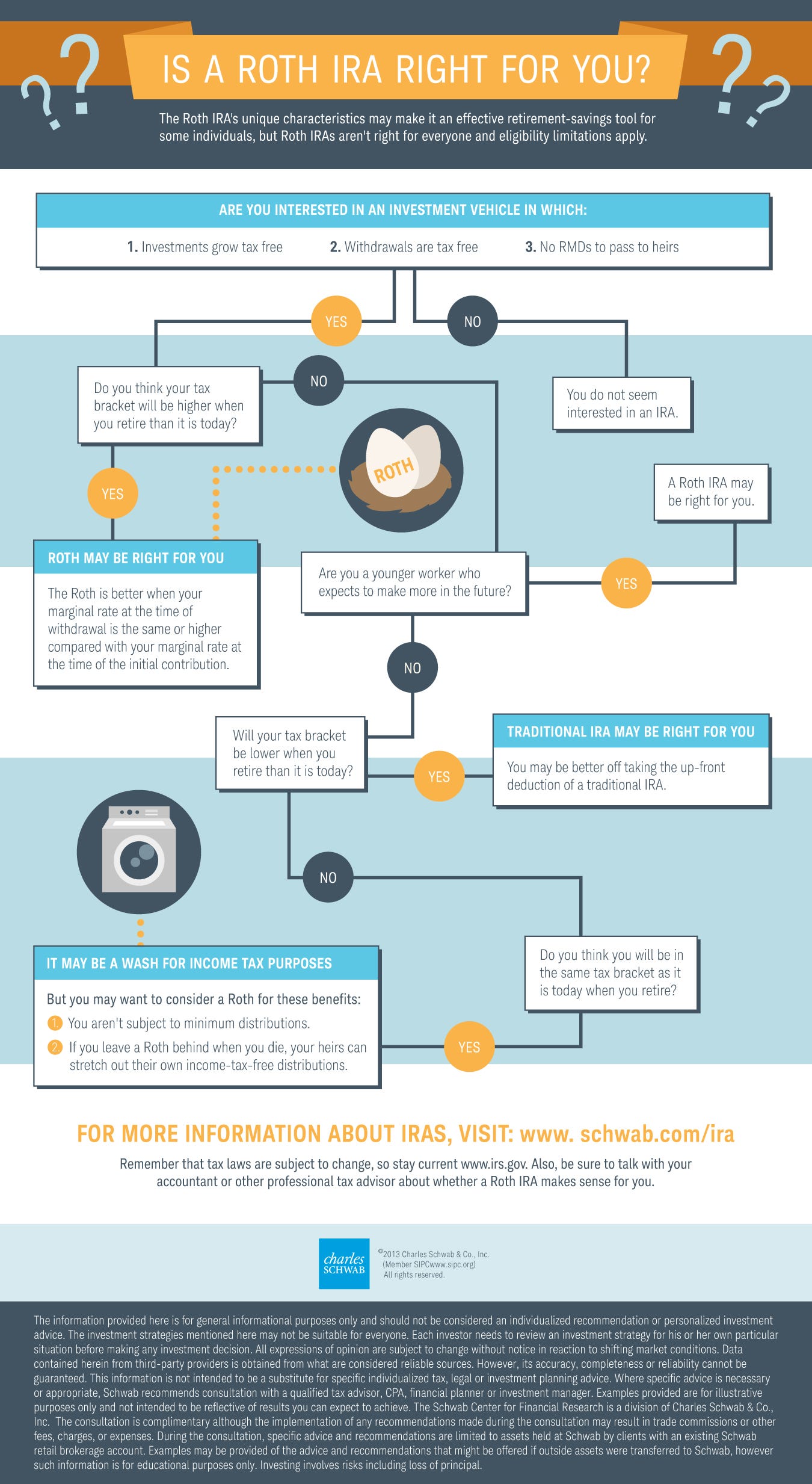

Okay, back to IRAs specifically: there are two types, traditional IRAs and Roth IRAs. While these accounts are similar, they differ in how they deal with tax breaks – that is, when you’ll see your tax advantage. When you contribute to a traditional IRA, your contributions are tax-deductible, but your withdrawals in retirement are taxable. By contrast, with a Roth IRA, your contributions aren’t tax-deductible, but your retirement withdrawals are tax-free.

So basically, ask yourself this: do you want to pay taxes now, or would you rather owe the IRS later? (Hint: try to predict what your future tax bracket will be. If you expect that your taxes will be higher later in life, it may be best to opt for the Roth IRA. If you think your taxes will be lower around retirement age, opt for the traditional IRA and claim your tax savings today.)

However, caveat emptor when making these decisions, warns Galina Portnoy, C.P.A., a tax preparer from New York. “Many Americans contribute to pre-tax retirement accounts – including traditional IRAs – to defer tax on contributed amounts, and with the hope that their tax bracket at the time of retirement will be lower. But this does not come to fruition for everyone, particularly in the case of individuals who have saved a significant amount of money,” she says.

“Many people enter retirement in the same tax bracket – or, in many instances, an even higher tax bracket – when they combine their investment income, Social Security, pension, and Required Minimum Distributions. Therefore, converting from the traditional IRA to Roth IRA could be a significant retirement planning technique,” Portnoy explains.

The bottom line? Choosing between an IRA (traditional versus Roth) does require some guesswork – but the important part is that you invest in one or the other.

Diminish Your Debt

This tip involves no ambiguous acronyms, but it does rely on a scary four-letter word: debt. If you’re drowning in it, don’t despair – you’re definitely not alone. According to a 2021 CNBC report, the average American has $90,460 in debt from credit cards, personal loans, mortgages, student debt, and other consumer debt products.

But the sooner you can break free from those clamorous creditors and monthly payments, the sooner you can feel more comfortable about your future retirement. “Getting out of debt and eliminating those monthly payments is the best financial move anyone can make if a financially secure retirement is the goal,” says Bill Westrom, a personal finance expert and co-author of Master Your Debt. “Monthly payments on debt are cash-flow and lifestyle killers. Long-term debt with a low rate and a low payment is nothing more than a long-term drain on your income,” he says.

If you don’t immediately have the resources to eliminate your debt, consider refinancing or consolidating your debt. “Refinancing can be a great way to lower your monthly payments on those obligations to the point where you can consistently put money away for retirement at the same time,” explains Melanie Hanson, editor in chief of EDI Refinance.

Commit to a Budget

If there’s one thing that scares me more than debt (and possibly death), it’s spreadsheets. But, it turns out, creating a budget spreadsheet can help you manage your fears about both!

“My best tip for a comfortable retirement is to budget early and often,” says Jake Hill, CEO of DebHammer. “Even if you’re in your 30s or 40s now, it’s not too late to start budgeting or to change your budget to something that works best for you. There are lots of different ways to budget that will suit anyone’s unique needs.”

You don’t need to start your budget from scratch, either. The personal finance website Nerdwallet highlights a number of free templates, including the site’s own budget worksheet here. Plus, you can choose from a multitude of budget planner apps to download on your smartphone, like Mint and GoodBudget, two highly-rated options on the app store.

Once you’ve created a realistic budget, make a point to commit to it. “Really committing to a budget and sticking to it allows you to save predictable amounts that you can then contribute to an IRA or another growth account for the sake of your retirement,” Hill explains.

Consider Your Insurance Options

Besides Medicare, the federal health insurance program that kicks in when you turn 65, there are two types of long-term insurance policies to consider when planning for retirement: long-term disability insurance and long-term care (LTC) insurance.

Long-term disability insurance replaces a portion of your income if you become unable to work due to illness or injury. On the other hand, an LTC policy helps cover the cost of daily assistance if you become unable to care for yourself. LTC insurance includes services like a home health aide, assisted-living facility, nursing home, or hospice care.

While some employer-sponsored insurance policies include disability coverage, these plans typically don’t cover LTC services, so you’ll have to enroll in a standalone policy. However, some financial experts advise picking a hybrid policy, where premiums are guaranteed for life – that is, not subject to increase like traditional LTC policies. “Long-term care insurance can be a good option, but it’s not the end all, be all,” says Kaylin Dillon, C.F.P., a financial advisor from Kansas. “If you are not sure you can afford the type of care you’d want if you needed long-term care, I usually suggest looking into a hybrid policy between ages 50 and 60. The hybrid policy is an investment that can grow and has value regardless of whether you end up needing the long-term care component,” she explains.

Make an Estate Plan

When we hear the word “estate,” we often associate it with the wealthy. But if you own property or have a bank account, you too have an estate, and you likely want some control over where your assets land when you’re no longer around (Hint: unless you’re this guy who was buried with his beloved Corvette, you’re probably not taking your assets with you.)

Estate planning involves naming the people or organizations you want to receive your assets when you die, and taking steps to ensure your wishes and instructions are followed. “[Make and] review your estate plan, even if you think you’re too young to need one,” advises Burns. “Make sure you have appointed someone to help you manage medical and financial decisions in the event you become incapacitated. If you have underage kids, make sure you have a guardianship plan in case something happens to you. Consider meeting with an estate planning attorney to draft the essential documents to make sure your wishes are honored,” she says.

Ease the Transition

And finally, like you would do before any major life change, try to prepare yourself mentally. “Last but not least, start thinking about the transition into retirement,” advises Dillon. “The people I’ve seen who have the hardest time with the transition to retirement were the people who led very restrictive lifestyles in order to save for a more lavish retirement, only to find they couldn’t bring themselves to spend their own money. The habits you build now are likely the ones you’ll carry into your senior years,” she says.

“Shedding an old habit is no easy feat. I hate to see people work for decades, then struggle to enjoy the years they thought would finally be a break from the grind. The easiest transitions I’ve seen were of people who blurred the lines between working years and retirement years by winding down their work slowly or by taking on new and meaningful projects in retirement,” she says.

Meaningful projects in retirement: sound familiar? If you were paying attention to the Freakonomics facts, you’ll recall this is precisely how you build cognitive reserve, the protective buffer against brain decay in later life.

And if you don’t remember? Don’t worry, there’s still hope for you – but go forth and pad your brain while you’re padding your accounts, because the most comfortable retirement is one in which you’re rich in both.

Feed your head.

How are you planning for your retirement? Do you have any experiences to share? Comment below!

Want More Finance Tips? Then You Should Read: